are hearing aids tax deductible in australia

By Moh Dadafarin Jun 5 2010 News. The deductions for these costs are only available to those who itemize their expenses.

Homepage Hearing Loss Association Of America

Unfortunately hearing aids are not tax-deductible in New Zealand.

. Hearing aids batteries maintenance. So if your AGI is 100000 per year you can typically deduct anything over 7500. Deductions can only be claimed if your total out-of-pocket health costs are more than 10 of your adjusted gross income.

HEARING AIDS ARE SUBJECT TO TAX REBATE. The deduction is for. Are Hearing Aids Tax Deductible In Australia.

Yes hearing aids are tax deductible. Unfortunately hearing aids are not tax-deductible in New Zealand. When you itemize your deductions make.

Contact Online Tax Australia for All Your Medical Expense Claims. You can claim the medical expenses tax offset for net eligible expenses that relate to. For the IRS to recognize your hearing aid tax credit you must ensure your deductions are itemized when you complete your tax return.

For example if you spend 8000 during the year you can deduct 500. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs. Not only can you deduct the cost of your hearing aids but the doctors appointments audiologist and the cost of testing can all be deducted.

The cost of hearing aids can be as high as 75 of your adjusted gross income so. Other hearing assistance items that are deductible include televisions and related accessories that amplify. But not all expenses are deductible leading to many people to ask.

Contact Us Ear Science Institute Australia from. Even if they are. If you are over 65 years of age this drops to 75.

Are hearing aids tax deductible. After 2018 the floor returns to 10. Which tax year is the deduction for.

Even if they are essential for improving your health or benefit your job or business they cannot be written off. You must reduce your eligible medical. Net expenses are your total eligible medical expenses minus.

Many of your medical expenses are considered eligible deductions by the federal government. Hearing aids and related costs including the cost of insuring your hearing aids are considered medical expenses. Therefore if you pay taxes remember to talk to your accountant about the possibility of any tax rebate for these costs.

Keep in mind due to Tax Cuts and Jobs Act tax reform the 75 threshold applies to tax years 2017 and 2018. If youve been searching for an experienced professionally qualified transparent accountant that understands all the ins and. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

By deducting the cost of hearing aids from their taxable income wearers could reduce. Its well known that deductions can be claimed for things like protective clothing work-related uniforms and occupation-specific clothing like barristers. Expenses related to hearing aids are tax.

Medical expenses in general can typically be deducted at the end of the year so long as they match or exceed 75 of your annual income. Now that we have an understanding of what can be claimed as a tax-deductible expense lets talk about how to go about claiming hearing aids on your upcoming taxes.

A State By State Guide For Hearing Aid Insurance Hearing Like Me

Evolution Of Hearing Aids Hearing Aids Australia

What Deductible Medical Expenses Can I Claim On My Taxes The Motley Fool

Hearmalawi Building Capacity Help From Malawians For Malawians Hear The World Foundation

Irs Announces New Tax Brackets And Standard Deduction For 2023

Here S How You Can Deduct The Medical Expenses Of Others

Why Are Hearing Aids So Expensive Starts At 60

Hearing Aid Insurance Compare From 7 Funds Finder

Costco Hearing Aids With Costs Retirement Living

Could A Data Tax Replace The Corporate Income Tax

![]()

When Is It Time To Update My Hearing Aids Oticon

Are Hearing Aids Tax Deductible What You Should Know

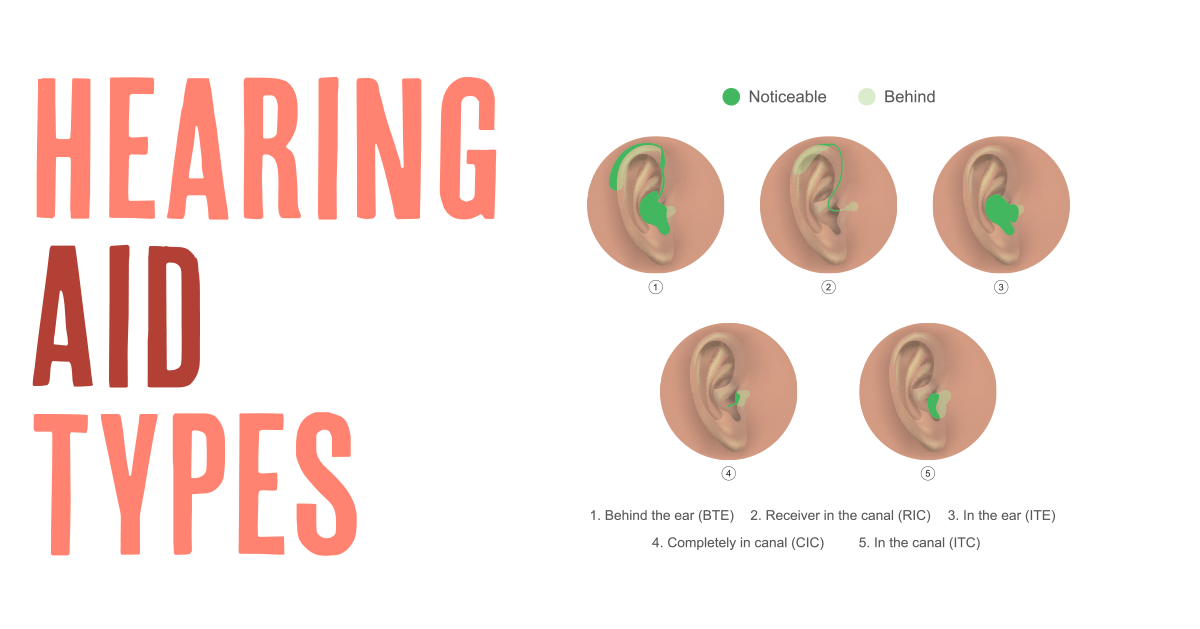

Hearing Amplifiers Vs Hearing Aids Differences Pros Cons

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Medical Expense Deduction How To Claim A Tax Deduction For Medical Expenses Bankrate

![]()

What Is The Price Of Hearing Aids Sounds Of Life

What Are The Benefits Of Ite Hearing Aids

Hearing Amplifiers Vs Hearing Aids Differences Pros Cons

Top 13 Ways To Fund A Hearing Aid In Australia Pristine Hearing Perth Hearing Aid Hearing Test And Tinnitus Specialists Adults Children